Easily Calculate Intrinsic Value of a Stock

Looking for a trustworthy toolkit to direct your investment explorations or delving deeply into the subtleties of stock market valuation? With the help of Intelligent Investor Online you can make informed and efficient investment decisions. Say goodbye to guesswork and embrace the power of data-backed investment decisions.

Find the Best Undervalued Stocks

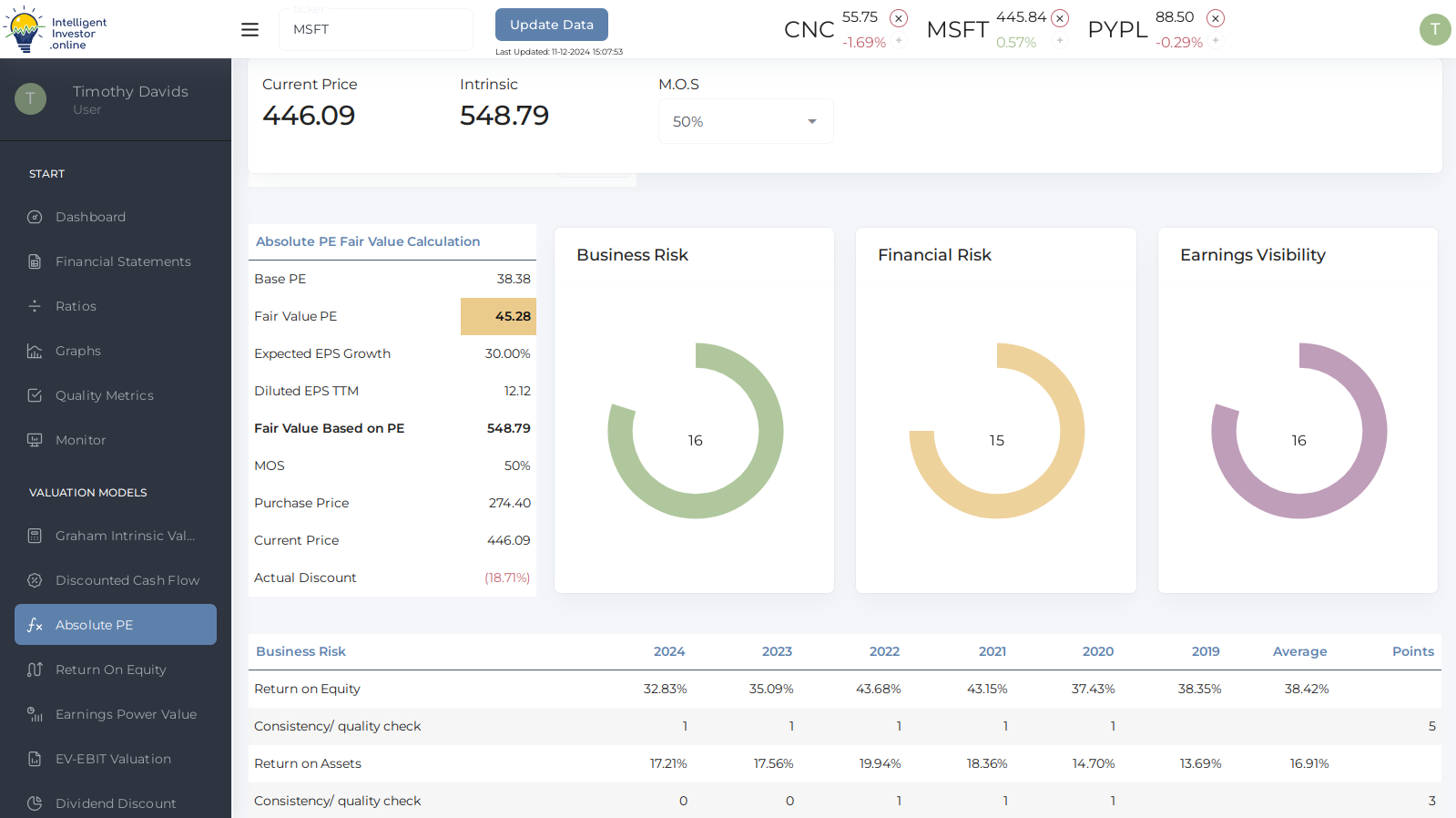

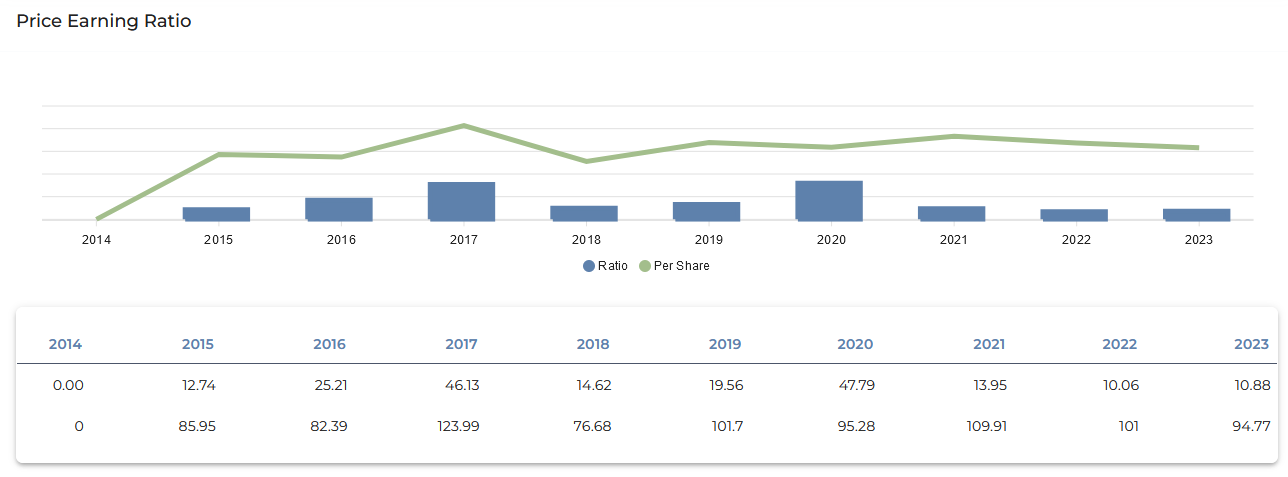

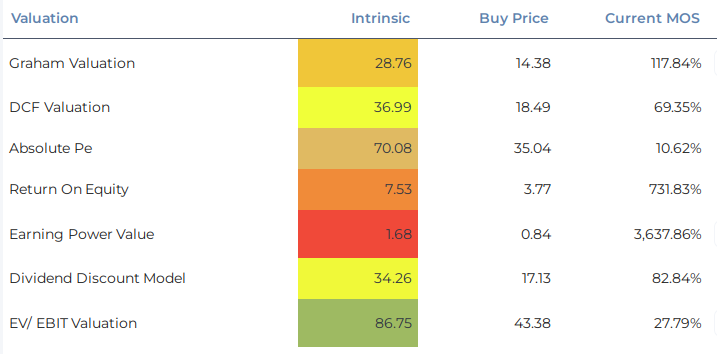

Finding a company's true or inherent value based on its fundamentals rather than its current market price is known as calculating the intrinsic value of a stock. You can determine a stock's true value and spot opportunities to purchase cheap stocks or steer clear of expensive ones by using techniques like discounted cash flow (DCF) analysis or comparing key financial ratios. In order to identify quality stocks, investors should focus on businesses with solid financial fundamentals, such as a low price-to-earnings (P/E) ratio, low debt levels, and steady earnings.

Following ideas from Benjamin Graham’s 1949 book The Intelligent Investor, investors pinpoint stocks likely to grow considerably over time by focusing on concrete facts. Known as Value Investing , this approach deeply shaped figures like Warren Buffett - who considers Graham’s lessons essential. Use Intelligent Investor Online to calculate the intrinsic value and make informed investing decisions.

Intelligent Investor Let's You

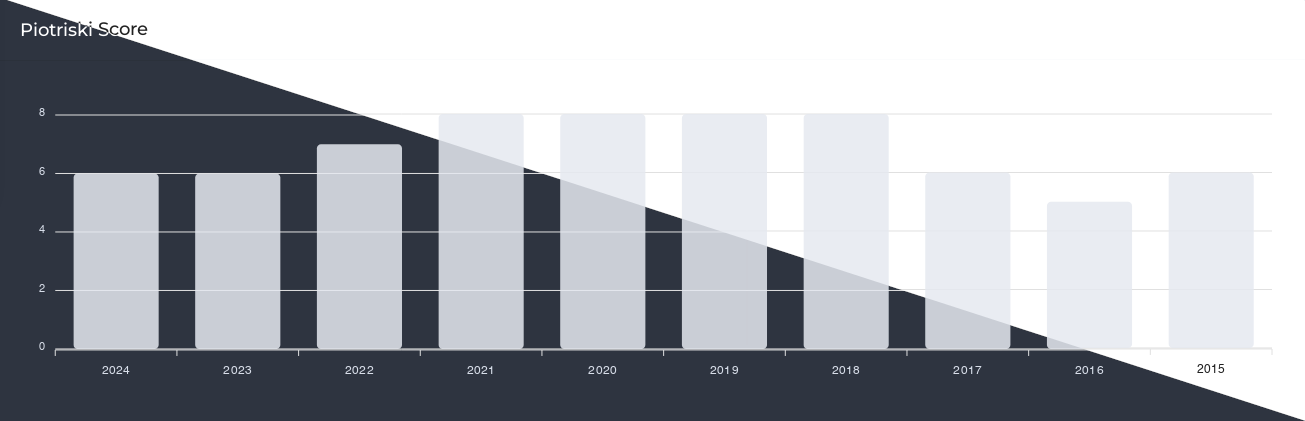

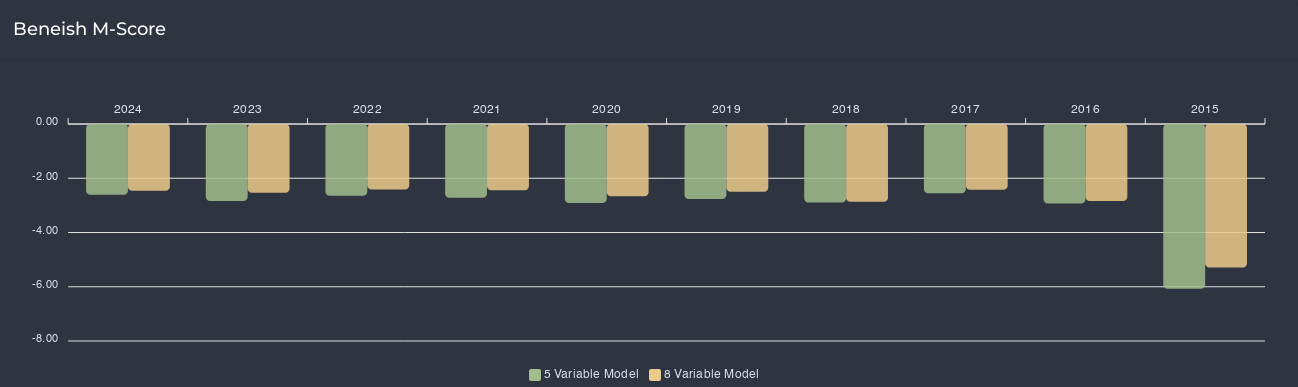

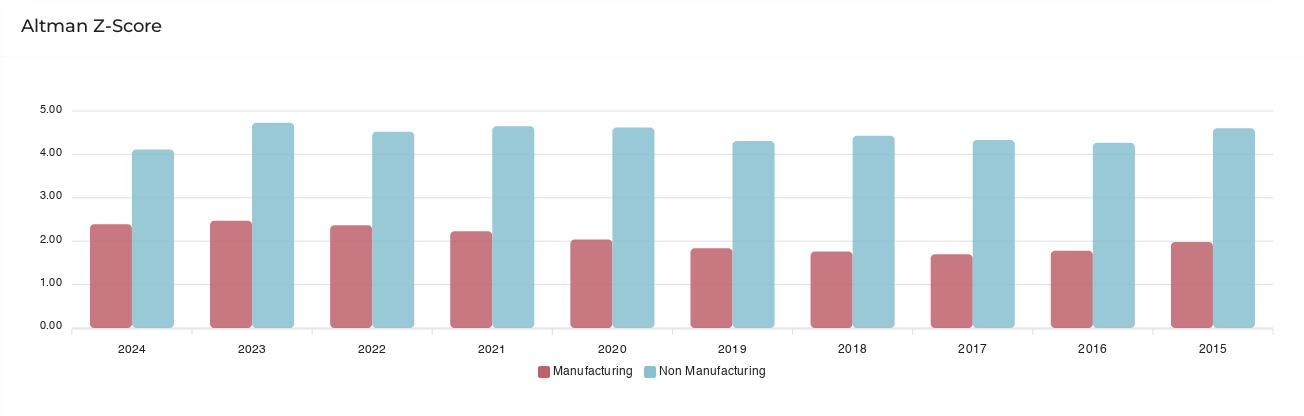

Visually Identify Trends

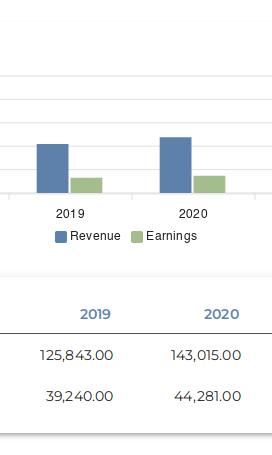

Visualize the results of various metrics using 10-year market data to quickly make an assessment of trends for your selected stock.

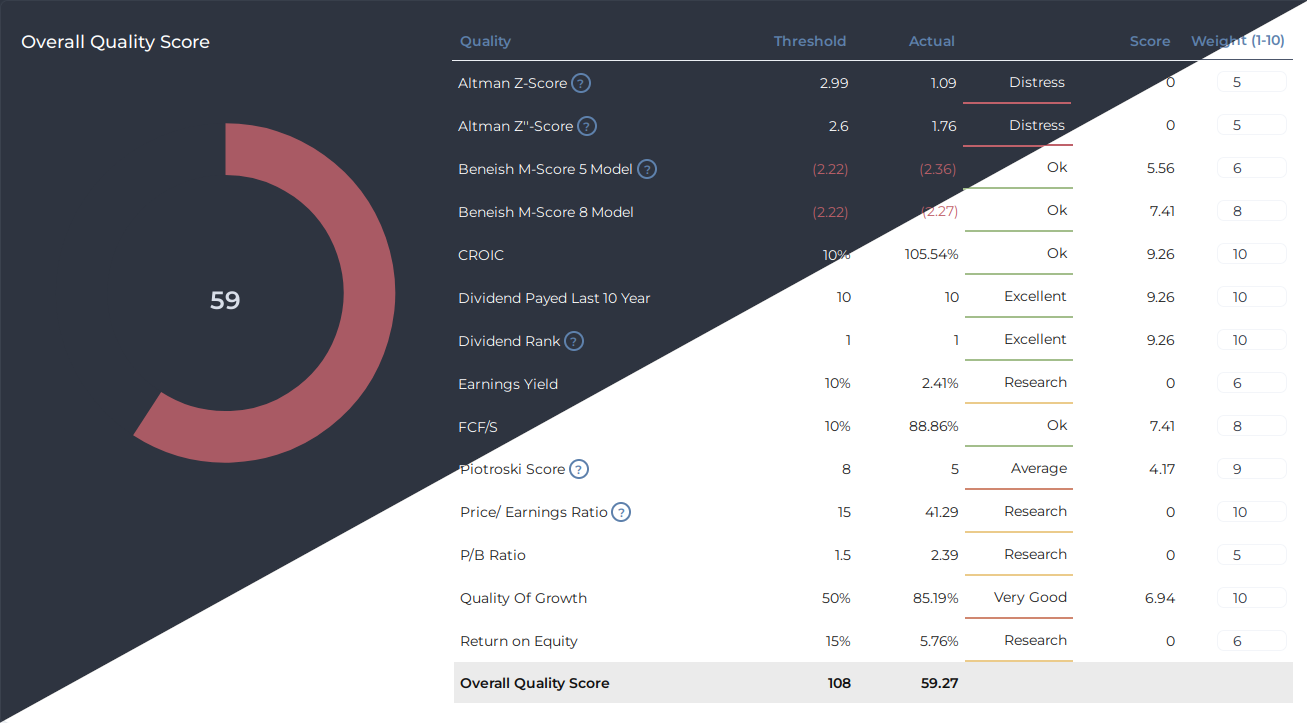

Personalize Quality Score

Use the quality score to quickly assess whether the stock you're considering is a high-quality company and meets your criteria. Customize the quality score matrix to reflect your unique investment strategies and investment preferences.

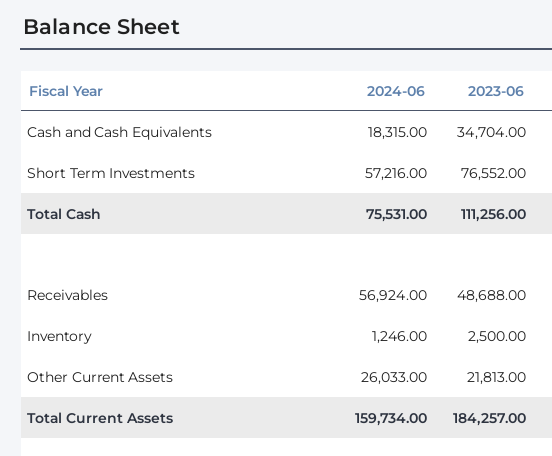

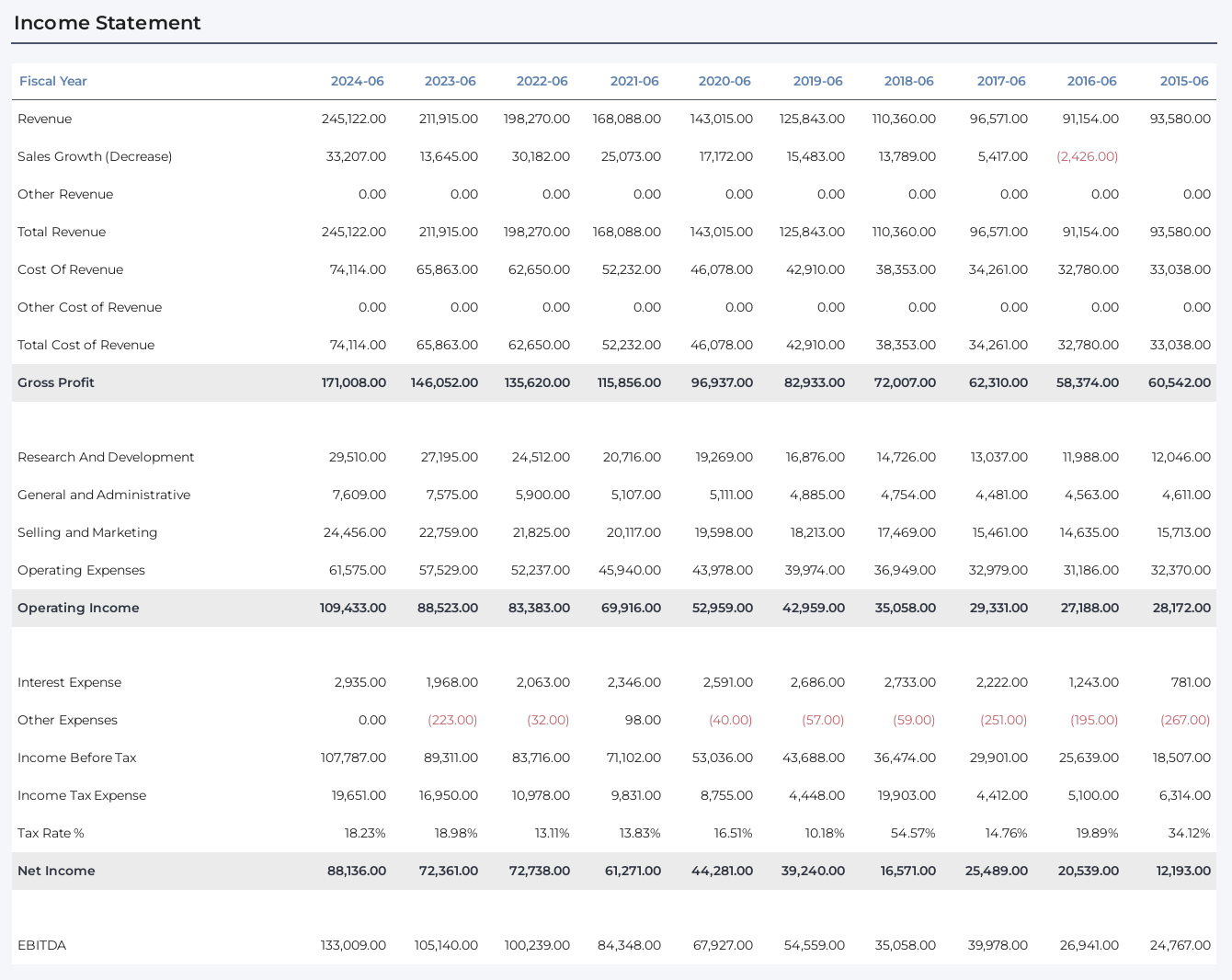

Research 10-year of Financial Statements

Take a deeper look at the financial statements of a company. Identify long-term trends with 10 years of professional graded financial statements for a company.

Visualize Quality Metrics

Focus on quality metrics and the real-life performance of companies and their earning power. Tap into in-depth financial metrics, including EPS, P/E ratios, and cash flow valuations.

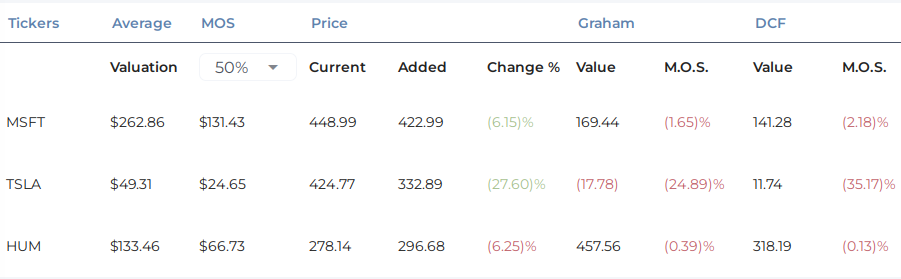

Track Your Favorites and Monitor Selected Stocks

Easily access and track your favorite stocks. Monitor their performance over time and see how they’ve performed since you began following them.

- See the result of various valuation models at a glance.

- Add a stock to quickly retrieve all data.

- Follow the performance of a stock in the monitor.

- Adjust valuation results by selecting your margin of safety.

Intelligent Investor Online, helps you to:

Understand the underlying financial situation of a company

Objectively analyze and interpret stocks

Find undervalued stocks

Buy stocks of healthy companies for the right price

Discover hidden gems

Increase your portfolio returns

Early Bird Offer

Explore the world of stocks now—unleash the potential of smart investing with us!

Create an account, verify your details, and log in. Then choose the subscription plan you prefer. Take advantage of our special 3-month Early Bird deal and gain full access to Intelligent Investor Online for just $15!

Early Bird

- 3 Months unlimited access

30-Day Plan

- 1 Month unlimited access

Annual Member

- 1 Year unlimited access

- Best value